Overview

Compound previously outsourced tax filing to external partners, forcing clients and advisors to navigate multiple disconnected systems.

With tax season approaching, the team had 7 weeks to launch an MVP integrating tax filing directly into the Compound dashboard.

The Challenge

A fragmented tax experience created confusion and operational drag

Before the redesign, clients lacked visibility into their filing status.

Advisors tracked filings manually across spreadsheets, Salesforce, and email threads.

This led to:

high support volume during tax season

repeated client follow-ups

hours of manual coordination by advisors

loss of structured tax data within Compound's ecosystem

Research

Understanding Advisor workflows and client anxiety

Research included:

Support ticket analysis from the previous tax season

Interviews with financial advisors

Conversations with the Head of Tax

Key Insights

Lack of visibility caused repeated client check-ins

Clients had no way to track the status of their tax returns.

Advisors relied on manual tracking systems

Tracking filings across multiple partners created operational risk.

Tax complexity required multiple service pathways

Not every client could file through the same provider.

Design Strategy

Balance discovery with eligibility

With a new tax partner, and two different user segments, the design team had multiple surface areas to cover:

We explored three wireframe approaches to present tax filing options to clients:

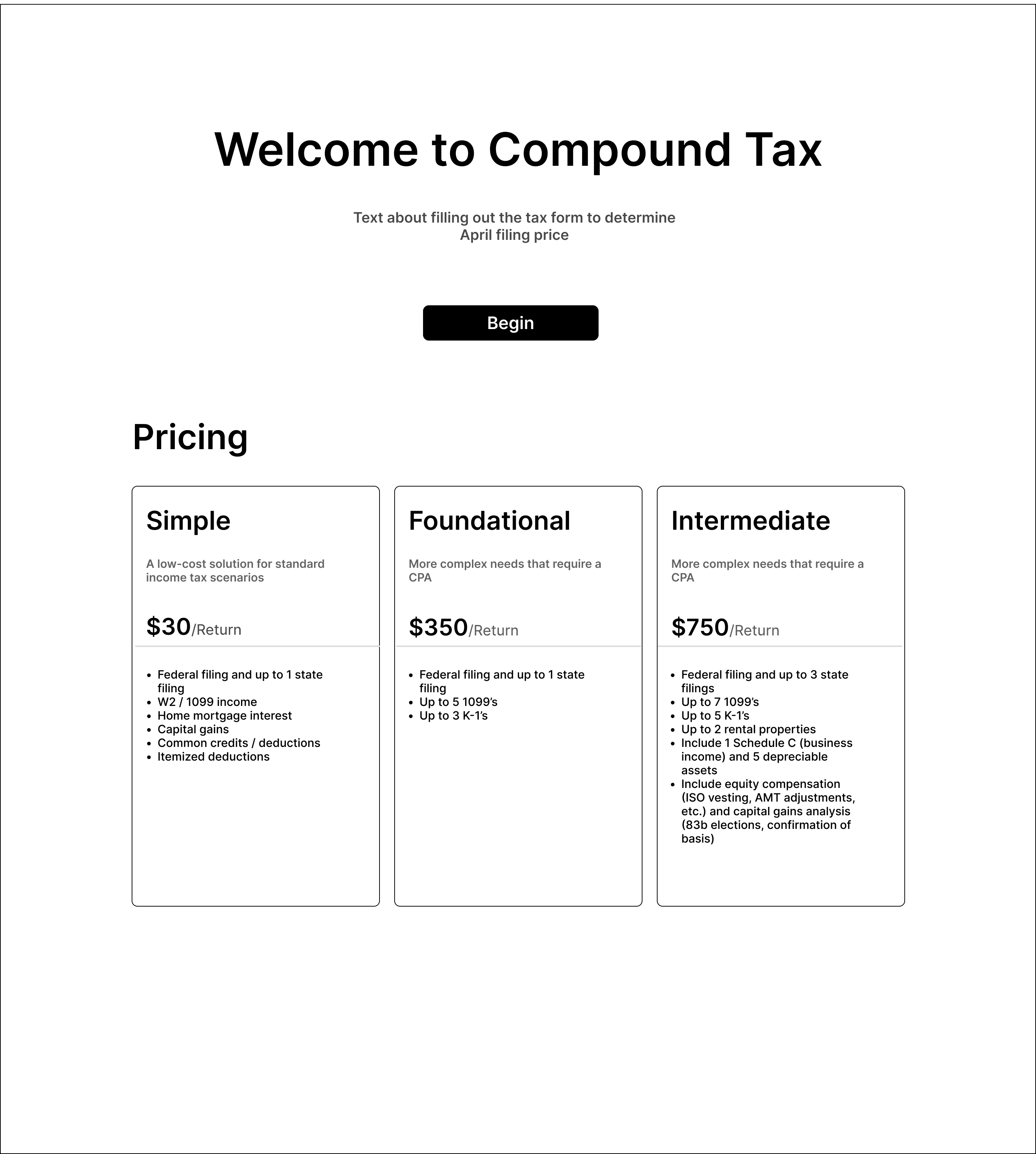

Mockup 1

Start Filing Immediately

Allows users to begin filing in-app with pricing tiers based on complexity, but risks users progressing through a flow only to learn their filing can't be completed in-app.

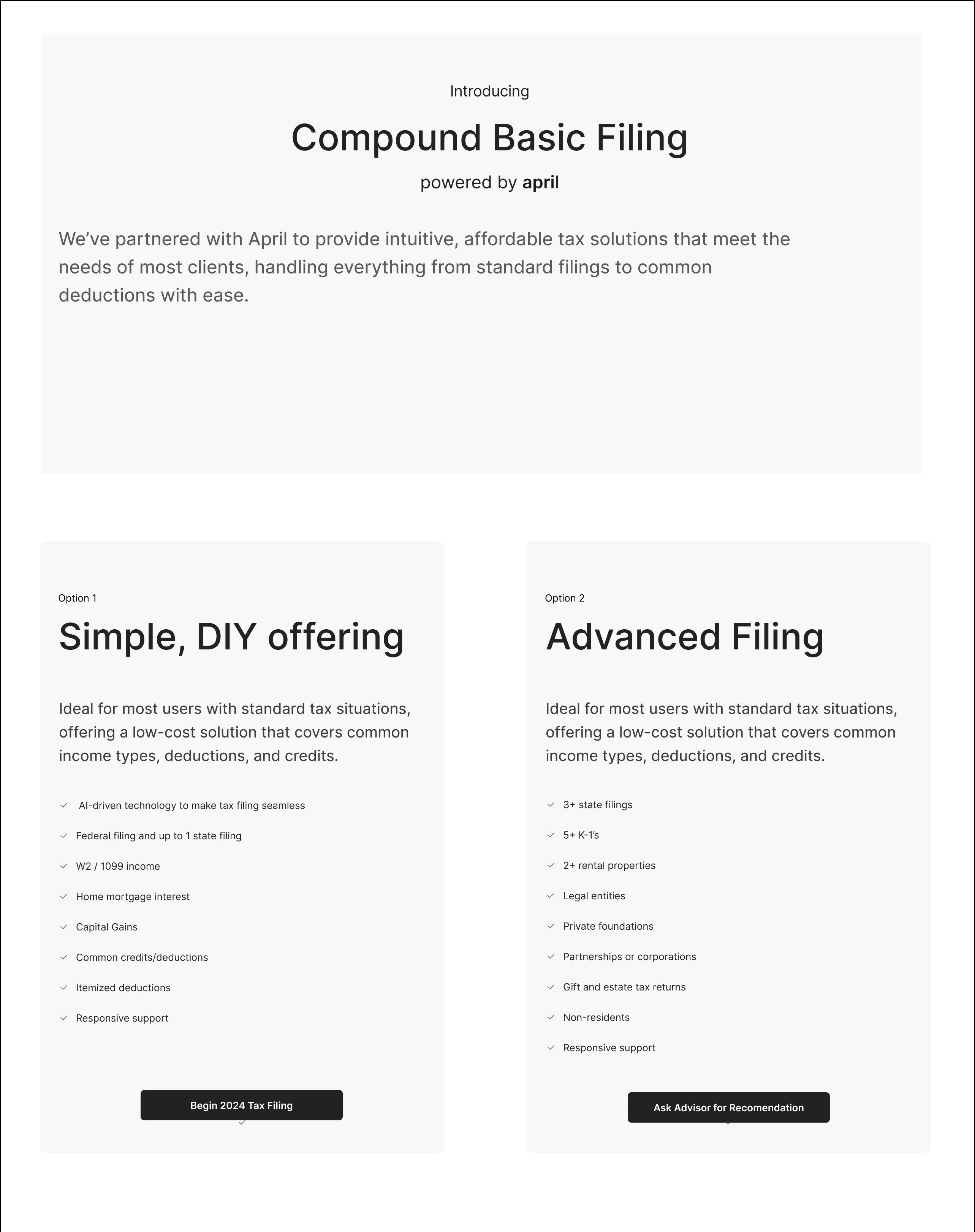

Mockup 2

Prioritize April integration

Emphasizes our partnership with April and enables immediate filing for two supported tiers, but excludes users with complex returns, limiting service discoverability.

Mockup 3

Show all options upfront

Surfaces all tax partners and pathways upfront, but introduced unnecessary cognitive load and unclear prioritization.

Design Execution

Key UX Improvements

After reviewing competitor booking flows, I identified patterns that reduced friction and used these insights to restructure the site around user intent.

Guide Client Discovery

The three tiers helped clients self-identify their tax needs based on complexity and helped reduce cognitive load, and increase confidence through clear upfront pricing. For April’s API-powered tiers (Tier 1 and 2), filing occurred directly inside the Compound dashboard which decreased advisor intervention for straightforward returns.

Status Transparency to Reduce Anxiety and Support Volume

We introduced a centralized landing page where clients could view their submission timestamp (to normalize tax processing timelines), assigned tax partner and current return status. Although external partner status data was limited, surfacing what we knew provided reassurance and aligned clients and advisors around the same timeline to reduce inbound support dependency and offer proactive visibility.

Track and Centralize Client Filings

For complex returns (Tier 3), clients triggered an advisor notification, and advisors selected the appropriate external partner within the system. This preserved flexibility for high-complexity returns, while also centralizing partner assignments within Compound, replacing manual tracking. Advisors also gained a unified client book view showing filing partner, filing status, refund/payment information and key tax metadata.

Outcomes

A fragmented process became a centralized product experience

The MVP shipped within 7 weeks, and transformed tax filing from a disconnected outsourced service into a structured product within the Compound ecosystem.

Overall, the redesign created:

greater client trust

reduced operational overhead

scalable infrastructure for future partners